ev tax credit 2022 texas

Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance. After the base 2500 the tax credit adds 417 for a 5-kilowatt-hour battery.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JYXYLACF3VPXHG634JTPZE6XD4.jpg)

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

A 7500 rebate on new EVs and a 4500 tax credit for used EVs.

. 8000 for a heat pump which can cool your home in the summer and heat it in the winter. Currently the plug-in electric drive vehicle tax credit is up to 7500 for qualifying vehicles. Ad Electric Efficiency With The Range Of Gas.

Various utility companies in the state offer rebates for Level 2 EV chargers with Austin Energy offering the most generous rebate of 50 up to 1200. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Tax Credits for Electric Appliances You can earn up to 14000 in credits for upgrades to your home completed between January 1 2022 and September 30 2031.

Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. The largest is the Light-Duty Alternative Fuel Vehicle Rebate which offers a credit of up to 2500 for buying an electric vehicle or plug in hybrid. Federal Tax Credit 200000 vehicles per manufacturer.

The minimum credit was 2500. 2 hours agoChanges to EV tax credit rules means only cars built in North America qualify. The minimum credit was 2500.

If you are interested in claiming the tax credit available under section 30D EV credit for purchasing a new electric vehicle after August 16 2022 which is the date that the Inflation Reduction Act of 2022 was enacted a tax credit is generally available only for qualifying electric vehicles for which final assembly occurred in North America. Couples that earn less than 300000 a year and individuals who earn less than 150000 a year are eligible for these benefits. State andor local incentives may also apply.

Find EV tax credits incentives by state. Compare Specs Of Our Electric Vehicles Like The IONIQ Or KONA Electric Find Yours Today. The phased-out tax credit offered buyers of electric and plug-in hybrid vehicles acquired after December 31 2009 as much as 7500.

Ev vehicle tax credit. The phased-out tax credit offered buyers of electric and plug-in hybrid vehicles acquired after December 31 2009 as much as 7500. August 11 2022 The federal EV tax credit will change if the Inflation Reduction Act is signed into law.

EV Tax Credit Expansion First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032. The US Federal tax credit is up to 7500 for an buying electric car. The act also sets the tax credit to a flat 7500 for new vehicles rather than being calculated based on overall battery capacity.

If you go with an all-electric vehicle the odds are higher that youll qualify for. The House is expected to pass it on Friday and then it will be sent to President Biden to be signed into law. The Light-Duty Motor Vehicle Purchase or Lease Incentive Program LDPLIP provides rebates statewide to persons who purchase or lease an eligible new light-duty motor vehicle powered by compressed natural gas CNG liquefied petroleum gas LPG or hydrogen fuel cell or other electric drive plug-in or plug-in hybrid.

Blank Forms PDF Forms Printable Forms Fillable Forms. This incentive covers 30 of the cost with a maximum credit of up to 1000. August 13 2022 by Nehal Malik.

Ford Transit Van. The credit is for the purchase of a new plug-in electric vehicle with at least 5kw hours of capacity. It has already been passed by the Senate.

The State of Texas offers a 2500 rebate for buying an electric car. The dates above reflect the extension. Starting next year buyers of used EVs will be able to receive a tax credit worth 30 of the sale price capped at 4000.

The incentives had been proposed to go as high as 12500 on new cars and up to 4000 on used electric vehicles. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. Production of Arrivals van is expected to start before the end of.

Tax Credits To encourage the transition from gas-powered vehicles the IRA includes tax rebates for electric vehicles. The credit amount will vary based on the capacity of the battery used to power the vehicle. The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar.

View the Latest Promotions on Nissans Award Winning Lineup. Ford Escape PHEV and Mustang MACH E. Avalara can simplify fuel energy and motor tax rate calculation in multiple states.

For every kilowatt-hour of capacity above 5 kilowatt-hours the credit goes up by 417 capping out at 7500. Back to Top State Local and Utility Incentives. Easily Download Print Forms From.

This is a combination of the base amount of 4000 plus 3500 if the battery pack is at least 40 kWh. That is money that the purchaser is able to claim in their taxes after purchasing an EV. The base credit was 2500 with taxpayers able to claim up to 7500 for cars with longer-distance batteries.

Whats more it looks to. It includes 369 billion USD in climate-related funding part of which will cover tax credits of up to 7500 USD for new and used electric vehicle EV purchases. Energy storage paired with solar systems are considered qualified expenditures eligible for the tax credit.

Its the same tax credit that currently exists which is a 7500 incentive for the purchase of an electric vehicle. 1 day ago2022 models that likely qualify for a tax credit under the Inflation Reduction Act. House of Representatives on Friday passed the Inflation Reduction Act IRA the largest climate bill ever passed in the country.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Texas EV Rebate Program 2000 applications accepted per year. IRS Tax Credit for Plug-In Electric Vehicles - Up to 7500 The IRS tax credit rewards a minimum of 2500 and may go up to 7500 so its worth figuring out how much youre eligible to receive.

Explore Our Alt-Fuel Models Find Yours Today. Small neighborhood electric vehicles do not qualify for this credit but. A head of the Inflation Reduction Act extending the tax credit of up to 7500 for purchases of new electric and hybrid vehicles Ford and General Motors announced price increases at similar rates.

The new law sets the. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline.

And potentially even more importantly these tax credits will be refundable. BMW 330e and X5. At least two model years old when.

Ad ev vehicle tax credit. To be eligible the vehicle must be. However there are certain conditions that determine eligibility.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

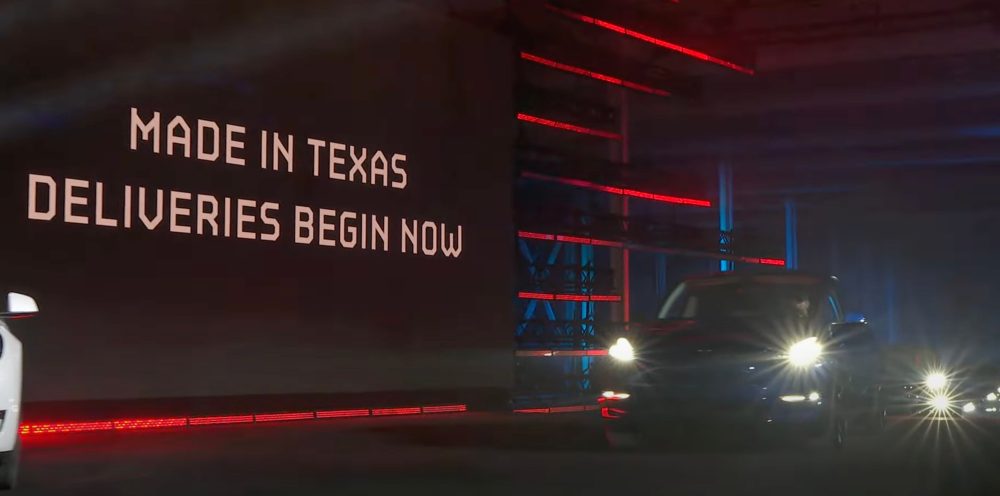

Tesla Delivered The First Made In Texas Model Y But It Is Still Being Vague About The New Version Electrek

2022 Texas Ev Trends Statistics To Know

2022 Texas Ev Trends Statistics To Know

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

2022 Texas Ev Trends Statistics To Know

2022 Texas Ev Trends Statistics To Know

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

Tax Break That Lured Tesla Tsla And Samsung To Texas Is Set To Expire Bloomberg

Tesla Ev Buyers Could Qualify For Tax Credits Under New Senate Bill

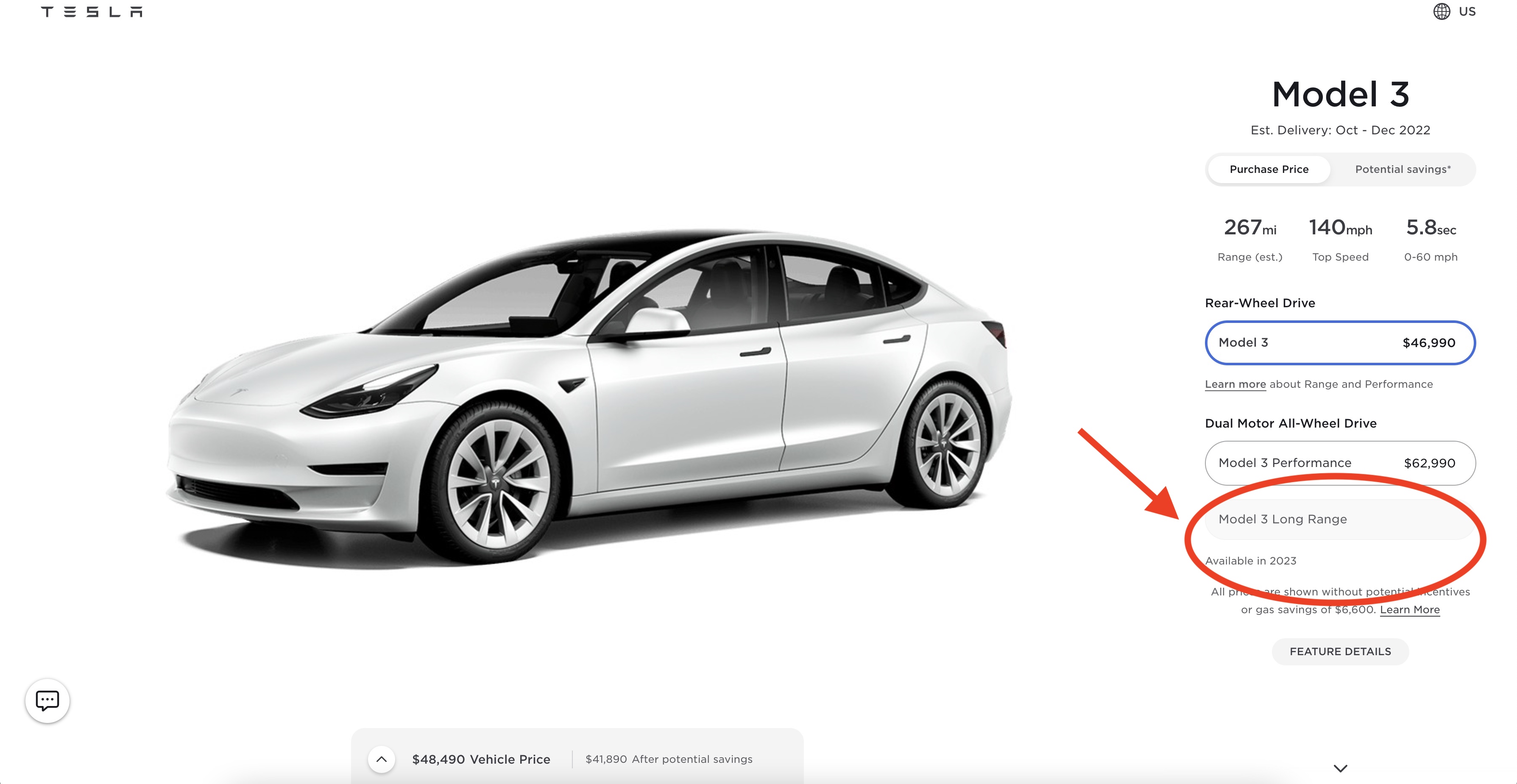

Tesla Model 3 Prices Specs Models Updates And More Electrek

2022 Texas Ev Trends Statistics To Know

Texas Ev Rebate Won T Apply To Tesla Due To Its Direct Sales Model Carscoops

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek